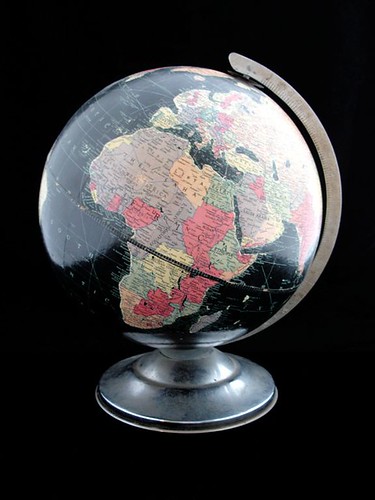

Am pleased to note that Saudi Arabia and Qatar are likely to lead recovery in the Gulf. Their proactive government support and spending have been instrumental in helping banks maintain relative stability. Can’t help reflecting how interconnected the world is.

Clik here to view.

We all know how the markets work, but isn't it incredible that Saudi Arabia on the other side of the world got hit by a global crisis made in the US? Shows how interconnected the world is, doesn't it?

Understand how the markets work, but isn’t it incredible that a financial crisis made in America can even hit Saudi Arabia. Not only is the kingdom on the other side of the globe, it also has more money than any other country in the world. Actually the Gulf banking sector as a whole faced a challenging 2009 with most countries facing limited or negative GDP growth, reduced liquidity, lower business volume, and a drop in asset values, representing a significant deterioration in banks’ operating environments. Mainly because of what started far away in the United States.

We are so interconnected what happens is sometimes crazy. Another example is the Swedish currency being hit by the problems in the Euro zone, despite the fact that Sweden’s budget deficit is next to none. At the same time foreigners investors have since the beginning of the year moved $21 billion into Swedish government bonds. And let’s not forget how North Korean sable rattling negatively impact markets world-wide.

Understand perfectly well that almost anything that happens can have an impact on the financial markets. However, what happens as a result is sometimes ludicrous. Where is the logic in Kim Jong-il being allowed to have a negative impact on anything, let alone the markets, outside of North Korea? The fact that he has gives him power he shouldn’t have. What are the chances of China lining up behind Pyongyang to start World War III? But financial markets all over the world still worry about it, which only plays into the hands of the little North Korean dictator.

For global markets, the renewed military tension on the Korean peninsula apparently came at a particularly sensitive time. The threat to South Korea’s fairly big economy — its GDP is four times larger than Greece’s — adds to the markets getting the impression of a world out of control. But why? Sincerely, there have been wars throughout history and we will have wars until the end of time, unfortunately. So why do the markets have to panic because of Pyongyang threatening to start another one? It’s all out of proportions. Not least since although the South Korean economy is bigger than Greece’s, it just accounts for 1,5 percent of global GDP. Europe on the other hand contributes 22 percent.

Maybe the markets impression that the world is out of control isn’t so far fetched? I’m truly international and would like to see the whole world becoming much more global than it is. But some of the negative effects are alarming. Thankfully Wall Street will now be regulated, but if the rest of the world doesn’t follow suit they will just start handling derivatives and other high risk financial products from offices elsewhere in the world.

Just read that until a few months ago, the governments, which had responded so powerfully to the financial crisis, were a comfort to the markets. But weak and wild policies around the globe are now suddenly undermining their conviction. Simply cannot comprehend how the markets could be unaware of the huge government budget deficits? Even I was aware of that escalating problem not only in Europe but also in the United States. How come the markets closed their eyes? And on top of it they suddenly decided it was a problem which wiped a few billion off the markets.

That the Euro slides against the dollar and investors head for the safety of gold makes perfect sense. But that while the Euro goes down European shares rebound sharply doesn’t make sense. Seriously I know this is how the markets work, but it’s crazy. The markets really are out of control. Or is it the whole world?

Photo: Patrick Q – Flickr